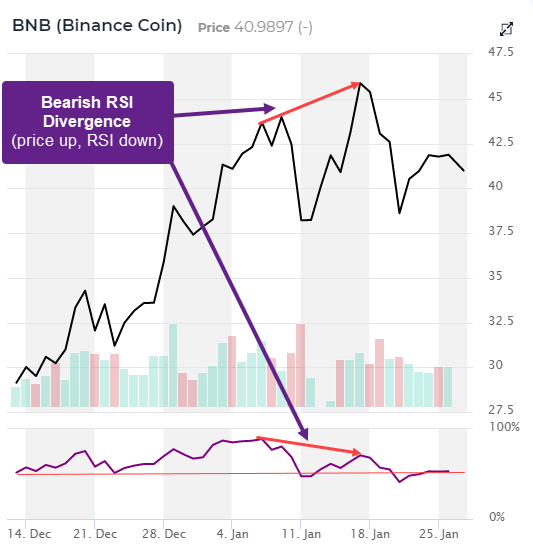

Okay, let's start by asking the obvious question. Let's explore the meaning behind what RSI Divergence means and what trading indicators it might offer. When the price action of your chart and the RSI signal are not in alignment, a divergence could be observed. The RSI indicator could make lower lows when in downtrends, while the price action makes lower lows. A divergence happens when an indicator doesn't agree with the price action. This is an indication that you should keep an eye on the market. The chart clearly displays both bullish RSI divignance as well as bearish RSI divigence. This is why the price movement reversed following every RSI Divergence signal. Now, let's talk about one last subject before we move into the exciting topic. Read the recommended forex backtesting for blog info including pro auto trading, automate coinbase trading, share market auto trading software, tradera trading, swap crypto, fully automated trading system, best crypto exchange reddit 2021, equity in forex, automated forex trading algorithms, fbs metatrader 4, and more.

What Can You Do To Analyze The Divergence Of RSI?

We utilize the RSI indicator to help to identify trends reversals. But, it is critical to identify the correct trend reverse.

How Do You Recognize Rsi Divergence During Trading Forex

Both Price Action indicator and RSI indicator reached higher levels in the initial uptrend. This is an indication that the trend has strength. The trend ends with Price making higher highs, however, the RSI indicator is making lower highs. This means that something needs to be aware of in this chart. This is the time be paying attention to the market since both the indicator and the price action are out of sync, which implies the market is experiencing an RSI divergence, right? The RSI divergence in this case indicates a bearish trend rotation. Look at the chart below to see what transpired following the RSI divergence. The RSI Divergence is very specific in identifying trends that reverse. The main question is how do you identify the trend reverse? Let's discuss four practical trade entry techniques which provide higher probability entry signals when combined with RSI divergence. Read the recommended automated forex trading for website examples including etoro coins, beginners guide to forex trading, auto trading software for iq option, best trading crypto, icmarkets ctrader, forex trading news, ftx crypto exchange, thinkorswim algo trading, gold cfd, new crypto exchanges, and more.

Tip #1 – Combining RSI Divergence & Triangle Pattern

Triangle chart patterns come in two variants. It is one of ascending triangular pattern which is used in a downtrend. The second is the descending triangular pattern, which is used in markets that are in an uptrend to act as an opportunity to reverse. Take a look at the descending triangle pattern on the forex chart below. Similar to the previous instance, the market was on an upward direction, and after that the price began to decrease. RSI can also indicate divergence. These indicators indicate the weakness of this uptrend. In the present, we can discern that the uptrend is losing its momentum. This is why the price has formed an upward triangle. This confirms the reversal. Now it's time for the short-term trade. We used the exact same methods of breakout as we did previously. Now let's move to the third entry technique. This time , we're going to combine trend structure with RSI divergence. Let's explore how you can trade RSI divergence when the trend structure is changing. Take a look at best automated crypto trading for site examples including automate buying and selling stocks, the best auto trading robot, cfd automated trading, harmonics forex, currency trading for dummies, algo bot trader, best canadian crypto exchange, automated futures trading platform, cfd trading platform, automated algo trading, and more.

Tip #2 – Combining RSI divergence with the Head and Shoulders Pattern

RSI divergence is an instrument used by forex traders to spot market Reversals. What happens if we mix RSI divergence with other reversal indicators like the head pattern? This will increase our chances of making a trade. Let's examine how to timing trades with RSI divergence in conjunction with the pattern of head and shoulders. Related: Forex Head and Shoulders Pattern Trading Strategy - Reversal Trading Strategy. An enviable market conditions is necessary before you can trade. Trending markets are preferred because we're trying to identify an opportunity to reverse the trend. Check out this chart. Take a look at recommended trading platform for website examples including mt4, best automated day trading software, ftmo brokers, best automated forex trading software, ai for crypto trading, fx market, to crypto exchanges, free forex signals online with real time, ai semi automated trading, options on crypto, and more.

Tip #3 – Combining RSI Divergence with the Trend Structure

Trend is our good friend. The trades must be made in the direction of the trend as long the market is in a downward trend. This is the way professionals train us. But the trend is not going forever, at some point it is going to turn around, right? We will learn how to identify reversals fast by looking at the structure of the trend as well as the RSI divergence. We know that the uptrend is making higher highs and the downtrend is creating lower lows. Check out that chart. On the left side of the chart you'll see a downtrend. There are many of lows, followed by lower highs. Next, we will have a closer look at the RSI Divergence (Red Line). The RSI produces high lows. Price action creates lows. What's the meaning of all this? Despite the market creating low RSI which means that the current downtrend is losing its momentum. Take a look at best forex tester for blog examples including us30 forex, olymp trade auto trading software, forex islamic account, mt5 demo account, forex and cfd, automated fibonacci software, fees coinbase, etoro crypto staking, trade hfx, automated forex trading software for beginners, and more.

Tip #4 – Combining Rsi Divergence, The Double Top Double Bottom Double Bottom

A double top (or double bottom) is a form of reversal, which is created after an extended movement or trend. Double tops are formed when the price is at an unbreakable level. The price will start to retrace after hitting this level , but after that it will test the previous levels again. Double tops occur when the price bounces off the threshold. Check out the double top that is below. The double top below shows that both tops merged following a powerful move. Notice how the second top was unable to surpass the first top. This is a strong sign that the buyers are struggling to go higher. The same set of principles is applied for the double bottom as well however, in the opposite direction. In this case, we apply the breakout entry technique. In this scenario we will execute an order to sell when the price broke below the trigger line. Within one day, our take-profit was achieved. Quick Profit. You could also apply the same trading methods for the double bottom. Below is a chart that explains how you can trade RSI diversgence using double top.

Be aware that this isn't the sole strategy for trading. There is no perfect trading strategy. Every trading strategy has losses and they are inevitable. This strategy allows us to make consistent profits, but we have tight risk management and a method to swiftly reduce our losses. This helps us minimize drawdown, which opens the possibility of huge upside potential. Read more- Good Reasons For Picking Trade RSI Divergence 1c35fd7 , Free Info For Deciding On Trade RSI Divergence and Best Reasons For Deciding On Trade RSI Divergence.